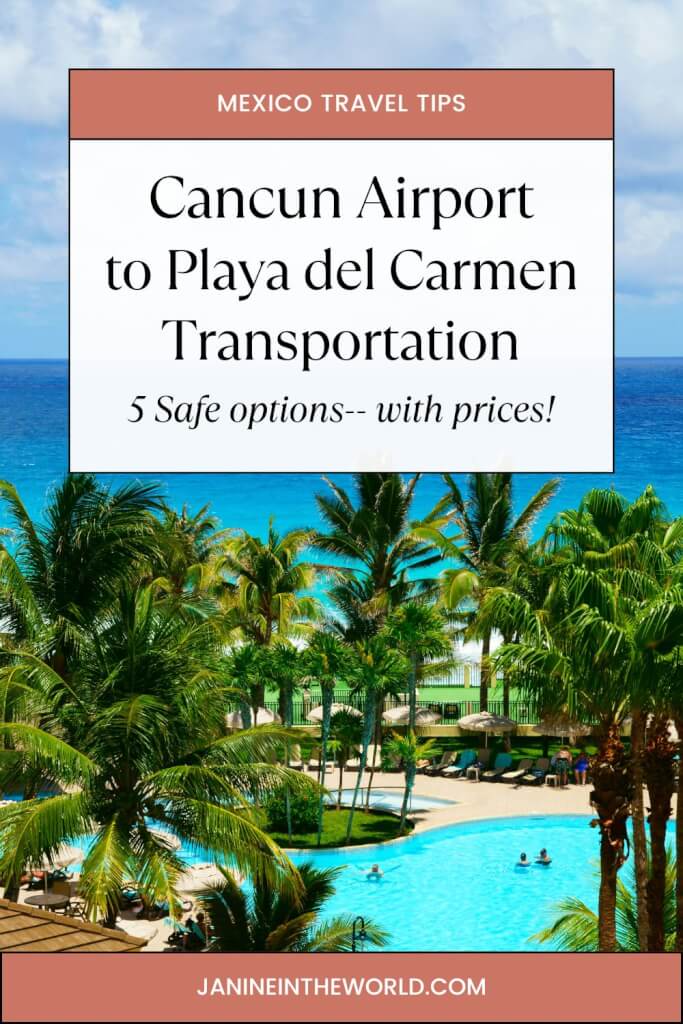

Cancun to Playa del Carmen: 5 Safe Transportation Options

This post may contain affiliate links. Read my Disclosure & Privacy policies for more detail.

Are you planning a trip to Playa del Carmen and wondering about the best way to get there from the Cancun International Airport?

As a solo female traveler, safety and convenience are paramount. Planning your airport transportation in advance is the best way to ensure a safe and comfortable arrival in Mexico!

Whether you’re looking for the most budget-friendly option, a speedy ride, or a bit of luxury, there’s a perfect transportation solution.

In this guide, I’ll discuss various transportation options from Cancun to Playa del Carmen, such as the ADO bus, private and shared shuttles, taxis, and rental cars, along with essential safety tips to ensure a smooth and enjoyable journey.

I lived in Playa del Carmen for about a year. During that time, I had the chance to try out all the different forms of airport transportation, so all of these insights are based on my experiences.

Let’s get your airport transfer sorted so you can enjoy all the great things to do in Playa del Carmen!

How far is Playa del Carmen from Cancun?

The distance from Cancun to Playa del Carmen is 42 miles (68 km). Depending on traffic, the journey takes about 45 minutes by car or an hour by bus.

There may be slowdowns due to police checkpoints outside Playa del Carmen. If you’re heading back to Cancun to catch a flight, allow yourself extra time, just in case.

Cancun Airport Shuttles

Estimated cost: $500 – $1500 MXN ($25 – $75 USD)

An airport shuttle is one of the most comfortable ways to get to Playa del Carmen, and it offers some perks that make it worth the extra cost.

Reasons to choose a shuttle service over other transportation methods:

- Door-to-door service from the airport to your accommodation

- They are typically modern, air-conditioned vehicles with comfortable seats

- Professional drivers who are safety-conscious and willing to help you with your luggage

- The vehicles are typically large vans or SUVs, making shuttles a good option for individuals or groups with a lot of bags

- They’re easy to reserve ahead of time, and reviews are available online, enabling you to feel confident in your choice (unlike a taxi, where you can’t access reviews).

The prices for shuttles vary depending on whether you opt for a private or shared shuttle.

Private airport transfer shuttles will transport you and your party directly to your destination without additional passengers.

Shared shuttles charge per person and can usually hold up to 15 passengers. Remember that shared shuttles will make many stops to drop passengers off at their destinations.

If you’re short on patience, book a private transfer.

Shuttles can be reserved online in advance or purchased upon arrival. Click here to check rates.

I recommend booking ahead for a few reasons:

- Pre-arranging your transportation gives you peace of mind. You know exactly how you’ll reach your final destination; you only have to locate the driver.

- Reserving in advance is often cheaper than purchasing upon arrival

- You won’t be at risk of falling victim to transportation scams because you’ve done your research and booked with a reputable company

Click here to reserve your Cancun airport shuttle.

How to get from Cancun to Playa del Carmen by bus

Estimated cost: $250 MXN ($16 USD)

The ADO bus is the cheapest and most convenient way to get from Cancun to Playa del Carmen, and you can catch it right from the Cancun Airport.

It’s efficient, comfortable, and safe.

ADO is a reputable bus company that serves southern Mexico and the Yucatan peninsula. They offer various service levels, with the most basic offering air conditioning and onboard bathrooms and the most deluxe providing complimentary snacks, luxurious lounge chairs, and a personal entertainment station.

There is no baggage limit on ADO and no baggage charge. You will have to stow your larger bags under the bus, but you should carry your personal items on board.

Keep your personal items close onboard. Theft is rare, but it happens occasionally.

Purchasing your ADO ticket at the airport

When you enter the airport terminal’s arrivals area, you will see an ADO bus ticket booth among the rental car and shuttle options.

You can purchase a bus ticket in cash for about 250 pesos. The ADO employees will then direct you where to wait for the bus.

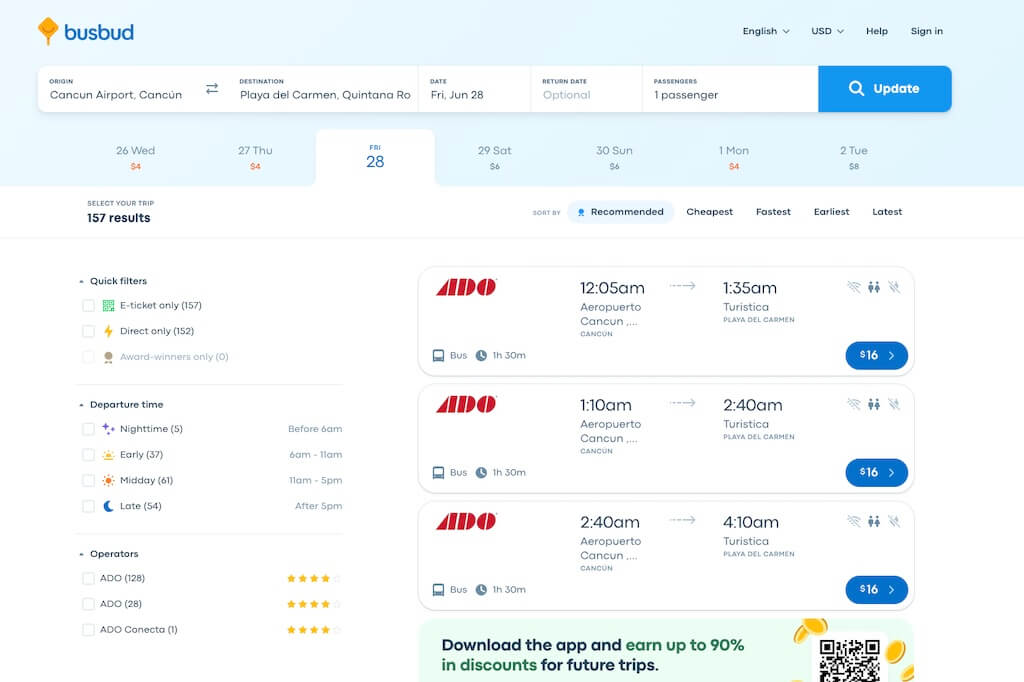

Buying tickets online

You can also purchase ADO tickets online in advance. The website does not accept foreign credit cards, but you can pay through your PayPal account.

Alternatively, you can book through Busbud, an English website that will accept your credit card.

The bus journey: what to expect

The journey from Cancun to Playa del Carmen takes 60 to 75 minutes by bus. Usually, there is a quick stop outside Puerto Morelos, about halfway between the two cities. Click here to book your ticket to Playa del Carmen on Busbud.

There are two ADO bus stations in Playa del Carmen:

- The Tourist Terminal (ADO Terminal Turistica) is in the heart of the tourist zone, on 5th Avenue. This is where most of the airport buses end up.

- The Alternate Terminal (ADO Terminal Alterna) is located in downtown Playa del Carmen, a few blocks from the tourist zone

Most airport buses are bound for Terminal Turistica but don’t worry if your ticket goes to Terminal Alterna.

The two stations aren’t far apart (less than ten blocks), and it will be easy to get a taxi to your accommodation from either one. Your bus ticket will state which terminal your bus is bound for.

For your reference, I’ve plotted both Playa del Carmen ADO terminals on this map:

Related Reading: The Ultimate Guide to Using the ADO Bus in Mexico

Taxi from the Cancun Airport to Playa del Carmen

Estimated cost: $800 – $1900 MXN ($45 – $100 USD)

I don’t typically recommend taking a taxi from the airport because I hear endless reports of taxis price-gouging weary travelers. If you want private transportation, booking a shuttle is the best way to go. It’s more reliable, and booking ahead ensures the price won’t spontaneously change.

That said, I wanted to mention taxis here in case you’re considering them.

When taking a taxi, it’s best to speak to the driver and agree on a set price in advance.

A taxi from the Cancun airport to Playa del Carmen should cost between 800 and 2000 pesos ($45 – $100 USD), depending on the driver.

Renting A Car in Cancun

Estimated cost: $50 – $75 USD per day

Having a car offers freedom from monitoring transportation schedules and makes it easier to explore harder-to-reach areas.

But, if you plan to stay in an all-inclusive or wish to spend most of your time wandering around town in Playa del Carmen, a rental car won’t be necessary.

Furthermore, given the limited parking available, a car often adds more hassle than it’s worth.

Between buses, taxis, and colectivos (local shuttle vans), the entire Riviera Maya is very well connected, making it easy to get to Tulum, Puerto Morelos, Akumal, and beyond without a personal vehicle.

A rental car offers a certain level of convenience, but you can explore the whole region without one.

My suggestion: If you’re unsure whether a rental car is necessary, get to your accommodation and settle in. Once you’ve got your bearings, you’ll know whether or not your trip warrants a vehicle. You may only need a car for specific Playa del Carmen excursions. Once you work out a loose itinerary, you can decide when to hire a rental car.

You can always rent one for the day to explore an out-of-the-way destination!

If you plan to rent a car, compare rates on Discover Car Hire to find a great deal.

Check out these tips for driving in Mexico before you hit the road!

Taking the Tren Maya from Cancun to Playa del Carmen

Estimated cost: $197 – $315 MXN ($11 – $18 USD)

The Tren Maya, or Maya Train, is a new transportation project that opened in the spring of 2024. The project is controversial, but the goal is to make the entire Yucatan region and parts of Chiapas more easily accessible for tourists.

You can take the Tren Maya from the Cancun Airport to Playa del Carmen. I haven’t done this personally, so I cannot comment on how easy (or not!) the process is.

Based on YouTube videos of the train, it is a comfortable travel experience. The train is modern, air-conditioned, and has bathrooms on board. Food and beverages are available for purchase.

According to the official website, the journey from the Cancun Airport to Playa del Carmen should take 46 minutes, with one short stop in Puerto Morelos.

Depending on whether you select tourist (lower rates) or premier class tickets, there are several different fare options.

Free shuttles run from the Cancun Airport terminals to the Maya Train platform, where you can board the train to Playa del Carmen.

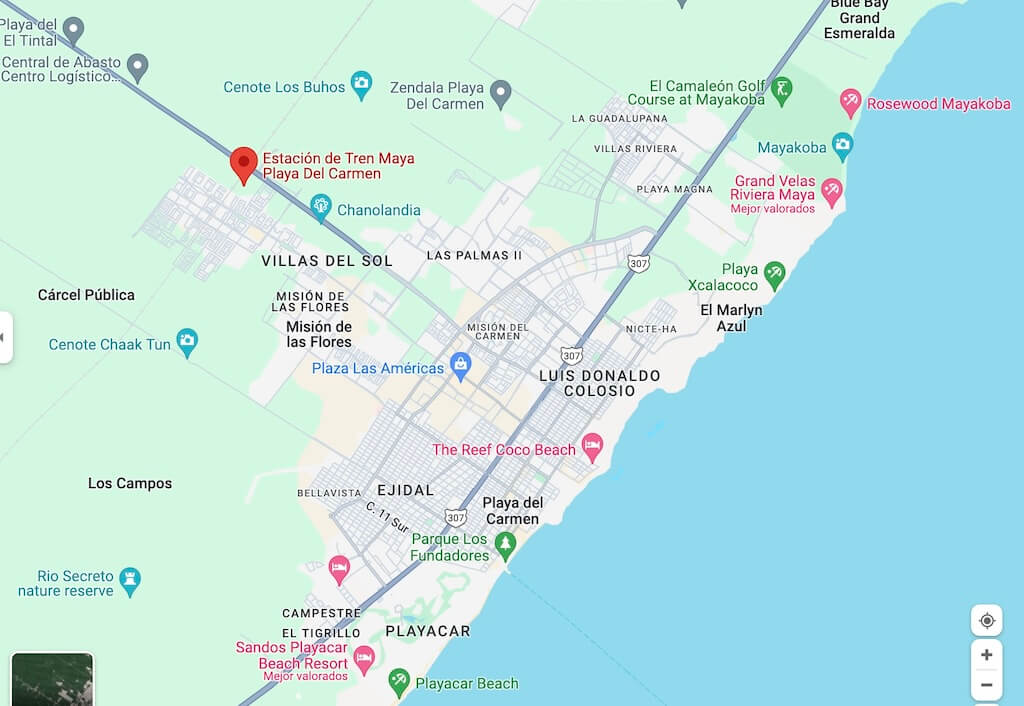

The train station in Playa del Carmen is located outside the city, so upon arrival, you should plan to take a taxi to your hotel. I’ve plotted the location on the map in the image below so you can see where the station is within the city.

Pro tip: Depending on where you’re staying in Playa del Carmen, taking the ADO bus may put you closer to your hotel because the ADO bus station is downtown.

Cancun to Playa del Carmen FAQs

Is Playa del Carmen nicer than Cancun?

Despite being resort towns, Playa del Carmen and Cancun are very different. Both cities have beautiful and gritty areas. What I love about Playa del Carmen is that the town is so walkable. If you stay in the center of town, you can easily walk from your accommodation to the beach, restaurants, nightclubs, and shopping!

What’s the cheapest way to get to Playa del Carmen?

The ADO bus is the cheapest way to get to Playa del Carmen. Tickets from the Cancun airport cost 250 pesos, and the journey takes about an hour.

Mexico Travel Planning Resources

🌡️ Do I need travel insurance?

Yes! Healthcare in Mexico is affordable for minor ailments, but travel insurance will give you peace of mind if an emergency arises. Plus, you can add coverage for trip interruption, theft, etc. Get a quote from SafetyWing.

🏨 What’s the best way to find accommodation in Mexico?

I use a mix of Booking, Airbnb, and Hostelworld.

Booking.com is awesome for booking hotels and resorts, Hostelworld is great for hostels, and Airbnb specializes in apartment rentals, making it a great place to find long-term stays.

💸 How should I exchange money in Mexico?

Use local ATMS to withdraw cash. US travelers should open a Charles Schwab bank account because they’ll refund ATM fees at the end of the month.

Travelers from outside the US should open a Wise account to secure the best currency exchange rates.

📱 Where can I buy a local SIM card in Mexico?

Pick up a Telcel SIM card at any convenience store. Or, buy an Airalo eSIM online so you’re connected as soon as you land.

🗣️ Do I need to speak Spanish in Mexico?

No, but it definitely helps you feel more confident and connected.

RocketSpanish is my favorite program for learning the foundations of the language. If you’re more focused on improving your conversation skills, hire a tutor through iTalki to prep for your trip.

✈️ What’s the best way to find affordable flights?

I use Skyscanner because it makes it easy to compare rates across different travel days.

🚖 How do I find a safe airport transfer?

I recommend GetTransfer for airport transfers anywhere in Mexico.

🚗 What’s the best way to find rental cars in Mexico?

I recommend Discover Cars because they aggregate prices across rental car companies, making it easy to find competitive rates.

🚐 How do I book bus tickets online in Mexico?

Plan your routes with Rome2Rio, and book your tickets with Busbud — the site is in English and takes foreign credit cards. (Read more here)

🤿 How do I find cool activities and tours in Mexico?

I recommend Viator and Get Your Guide. Viator usually has more options, but it’s worth comparing offerings across both platforms.

🇲🇽 How can I experience Mexico like a local?

Solo female travelers can hire a local female guide through Greether. Greeters will tailor tours based on your interests— it’s basically like experiencing a destination with a local bestie!

🧳 What’s the best luggage for Mexico?

Unless you’re staying at a resort, a travel pack is recommended. I’ve used this one from Osprey for the last 8+ years.

👯♀️ How do I connect with fellow travelers in Mexico?

Join my Female Travelers in Mexico Facebook group, a supportive community of fellow Mexico travel enthusiasts, where you can find answers to all your travel questions!